West Worcestershire MP Harriett Baldwin has today welcomed a Budget which sees taxes cut for 27 million working people alongside important measures to help more families with child benefit payments and freeze in fuel and alcohol duties.

Chancellor Jeremy Hunt today announced that he would take a further two per cent off National Insurance payments in addition to the changes which came into place in January meaning that next month the average working family will be £900 better off.

And Harriett successfully lobbied for changes to the child benefit regime and the Treasury will raise the threshold and halve the rate at which Child Benefit is withdrawn, benefiting some parents by an average of £1,260.

In addition to a tax increase on tobacco a new duty was proposed on vapes, protecting young people and children from the harm of vaping.

Small businesses will benefit from an increase in the VAT registration threshold for the first time since 2017, raising it from £85,000 to £90,000.

The Household Support Fund, which has provided important financial support to local people through agencies like Citizens Advice, will be extended.

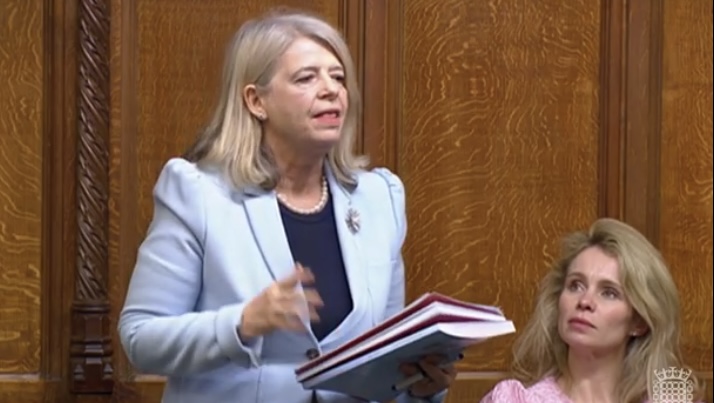

Harriett commented:

“Every working person will be able to benefit from a second tax cut this year with a total of a four per cent reduction in National Insurance meaning that working people will take home more of their hard-earned pay.

“I am pleased to see the welcome changes in child benefit thresholds making the system fairer and encouraging more workers to take on promotions and additional hours of work.

“Local drivers will be relieved that 5p off fuel is in place for another year making life easier for motorists.

“The economic forecasts show that inflation will continue to fall from the peak of 11 per cent last year to within its two per cent target later this year.

“This was a strong and confident budget to reward working people and sticks to the plan to deliver long-term growth.”