Harriett Baldwin welcomes the Budget which has both special measures to tackle the coronavirus outbreak and delivers on the promises of the election manifesto.

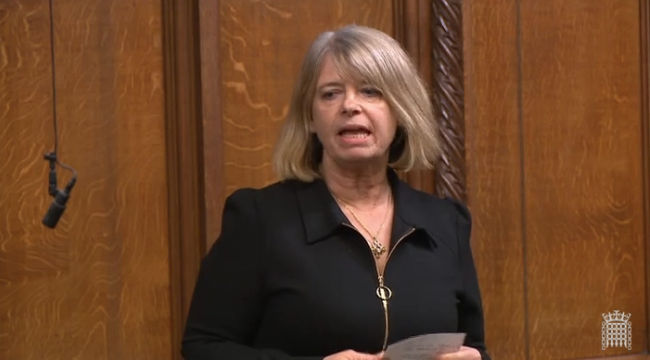

Harriett Baldwin (West Worcestershire) (Con)

It is, I think, a pleasure to follow the hon. Member for Glasgow Central (Alison Thewliss), who sits with me on the Treasury Select Committee, which has eight women members out of 11. I think I did detect one thing that she welcomed in the Budget, which was the end of the tampon tax. I was glad to hear one thing that she welcomed.

The Budget was delivered in truly exceptional circumstances, in the context of a coronavirus outbreak. As we sit here today, the US stock market opened down at its limit again and had to close for the second time this week. This is truly a difficult and challenging economic environment for the Chancellor as he delivers his Budget. I am sure that all colleagues were impressed with the way in which our new Chancellor delivered the Budget. He did so with the confidence that looked as though he had been working all his life to deliver it, whereas he had been in post for only four weeks. It was a remarkable performance that got an exceptional Budget done in exceptional times. It delivered on so many of the promises in our manifesto—promises that the British people voted for last December.

I have heard a number of people this afternoon reference the unprecedented nature of the coronavirus, and I think everyone has welcomed the measures that were taken in the Budget. They all reflect the fact that this is a temporary situation; we know that it will come to an end, but we do not know when. The measures were also timely, and they were very targeted at those who will be most adversely affected. I think there was a collective agreement in yesterday’s speeches and today’s that the measures were necessary and welcome. They also come against a backdrop that continues to be very distorted in certain fundamental ways in terms of the global economy and in terms of our own economy. It is quite remarkable that this week—on Monday—the two-year bond in the UK switched to a negative interest rate for the first time. Before I came into politics I was a portfolio manager for over two decades, and I never saw anything like this. What is happening on the markets is really quite unprecedented.

Similarly, since the financial crisis, when the Bank of England implemented quantitative easing and added Government bonds to its own balance sheet, it has not been able to unwind those holdings. It has actually had to increase them over the past decade, holding now some £425 billion-worth of bonds. There are some really fundamental and long-standing distortions on the Government’s own balance sheet. Twelve years on from the financial crisis, the Government still, on behalf of taxpayers, hold shares in RBS. I know that the Red Book says that the Government are planning to reduce those holdings by 2024, but I note that since January the value of those holdings has fallen by half. I would love to hear from the Minister what the plans are for the RBS shares.

There was also a lot in the Budget statement about the long-term plans for levelling up the British economy, and a lot that we can welcome across the House in terms of long-term infrastructure spending. We all recognise—certainly on the Government Benches—that Governments have no money of their own. They have only the money that they can borrow or the money that they can take in taxation from a productive economy. The growth in public spending that is in this Budget is much faster than the overall growth that is projected in the economy. Government Members all recognise that this is an exceptional response to exceptional circumstances, but we cannot carry on doing that. As the Institute for Fiscal Studies said today:

“Obviously, that is not sustainable for any prolonged length of time.”

Effectively, what the Chancellor did in the Budget was to say that the money that is going to be invested in the long-term plan—that levelling up, that infrastructure investment—is going to generate a greater rate of return for the economy than the OBR assumes in its forecasts. I can see that in my constituency, where I am campaigning for the redoubling of the Cotswold line, for example. There is a proposal on the table for nine miles of Cotswold line to be redoubled. That has a business case of a 4:1 ratio, so it is clearly something that would be really positive for the local economy. The Secretary of State spoke in his opening remarks about the research and development spending that is in the Budget, and he mentioned that there is a 7:1 ratio for spending on research and development. I can see it in terms of the spending for flood defences that is in the Budget. How valuable that will be for the communities in West Worcestershire that I hope will benefit from it. The same can be said for investment in superfast fibre and improving rural mobile phone signals. This money should receive a greater rate of return in economic growth than is currently forecast by the OBR.

I have three quick questions in the minute left to me. First, on the £22 billion of public R&D investment and the £800 million specifically for an advanced research projects agency, will it link with what we are doing on defence research budgets through the Defence Science and Technology Laboratory and taking some of those inventions to market through the Ploughshare scheme? What is the vision for those investments? In what sectors will they likely be invested, and how will we measure success over time? Secondly, are we extending the maturity of our debt and taking advantage of these low interest rates? Thirdly, as I mentioned before, what is the plan for RBS?

Finally, I recognise the exceptional conditions in which this Budget was delivered.