Harriett Baldwin welcomes the Bill which offers a safer and greener financial future but calls for better visibility of pension admin charges and raises concerns about the risks of pensions investing in index-based funds where the index is driven by large carbon-based industries in the UK.

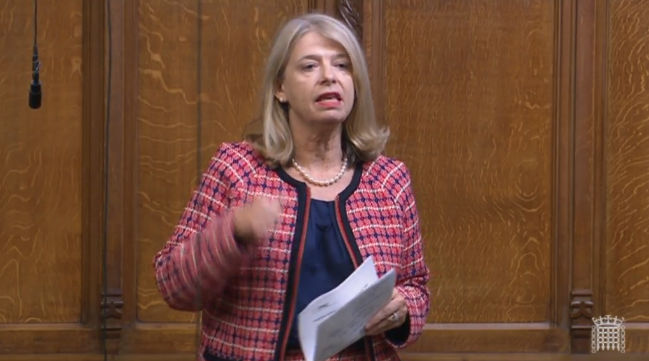

Harriett Baldwin (West Worcestershire) (Con)

I welcome the Bill, which is a milestone in the country’s journey to a safer, better and greener financial future, in which more people are saving for their old age. I echo the warm words spoken by the Secretary of State about the work of the Under-Secretary of State for Work and Pensions, the hon. Member for Hexham (Guy Opperman)—the Pensions Minister—who has a true passion for improving the future not only of his constituents in Hexham but of all our constituents.

This has been an incredibly well-informed debate and I hesitate to add anything, but I do want to bring my perspective, as someone who used to work on the dark side as a pension fund manager, and to make the obvious point that there are three main things that ensure that people have a good pension in old age. The first is starting as young as possible. I was interested to hear Members arguing about starting as early as 18. I certainly think that the Government should seriously consider such a provision, if people meet the earnings criterion. The second thing that makes people’s pensions better over the long term is tax breaks and employer contributions. The earlier that people can pay in the maximum before tax that they are allowed to and get the employer matching that amount, the better off they are going to be in retirement.

The third thing that makes people better off through their pension is lower charges. This subject has not yet come up during this debate, but it is incredibly important to put on the record. The charges in this incredibly competitive industry, in which the UK leads the world, can vary dramatically. I hope that the powers in the Bill will enable our constituents to see much more clearly on their pensions dashboard what they are being charged and for what. As someone who used to work in the industry on the receiving end of the charges, there is no question but that the compounding effect can have a meaningful impact on the final outcome of people’s pensions.

Will the Minister comment in his closing statement on the charges that the National Employment Savings Trust levies on our constituents? NEST is the body that was set up because, through auto-enrolment, there will be some very small and uneconomic pots that the industry will not want to take on. I recall from my time on the Select Committee on Work and Pensions that NEST itself charges really quite vicious amounts to people who are putting their money into a NEST scheme. I seem to recall that it was something like 1.8% up front and then an ongoing annual charge of 0.3%, which sounds low, but is not actually that competitive these days. Despite that, I understand that NEST has not been able to make enough money to repay the loan that the taxpayer gave to establish it. I would be interested in an update and in the Minister’s thoughts on how we can ensure that people who are using NEST do not end up paying particularly onerous charges.

Let me turn to climate change risk. The Treasury Committee, on which I serve, is currently doing an inquiry into green finance, and it is clear that the UK has a huge opportunity to make the most of our leadership—not only on climate generally, but also as a financial centre—to be the go-to place for green finance, green investment and green bond insurance. I heartily endorse the call of my hon. Friend the Member for Grantham and Stamford (Gareth Davies) for the UK to show the way not just by being the place where other countries come to issue green bonds, but by being the country that issues green bonds itself to invest in greening our economy.

I want to highlight something that we heard clearly in evidence this week. The former Governor of the Bank of England, Mark Carney, has repeated that the cost of climate risk is not being priced into our stock market. There is quite a significant risk that investments in some large companies that form a large part of the index in this country—we should bear in mind how much investment goes into indexed funds—are held as assets that could end up being trapped in value.

Guy Opperman

I am grateful to my hon. Friend for what she is saying, but on what Mr Mark Carney has said, she will be aware that he is a member of the Task Force on Climate-related Financial Disclosures. Under the Bill, the UK will be the first G7 country to bring that into statute. The advantage of that is that the very aspect that she has highlighted as a problem—FTSE 100 companies are not aware of what the risk is from climate change to the way in which they do business—will be tackled, as they will now be forced to disclose that on an ongoing basis to the wider market and individual consumers with pension investments. I believe that the issue raised by Carney, the Treasury Committee and others is addressed in the Bill and the consultation that accompanies it.

Harriett Baldwin

I welcome what the Minister says, and I did not want in any way to undermine the provision in the Bill and the incredible progress that it represents on our journey to a greener financial future. I welcome those steps wholeheartedly, but I wish to highlight that those risks, although disclosed, will be there. Many of our constituents, every month in their payroll, put investments into index-based funds in which those risks are inherent. It is incumbent on us all to recognise that that could be a big driver of UK returns, given that a significant portion of the index consists of carbon-based industries in the UK.

I make that point, and I make the point about charges, because the pension dashboard will play a vital role in showing people what they are paying for those returns in an environment where interest rates are virtually zero, where the index has quite a lot of climate-affected assets, where charges can be as high as those from NEST, the state-backed provider, and where investment returns could be lower for a protracted period as we recover from the pandemic. It is worth flagging the fact that giving information on charges in particular and the way in which they compound over a lifetime will be a powerful part of the very many welcome changes that we can see in this excellent piece of legislation.