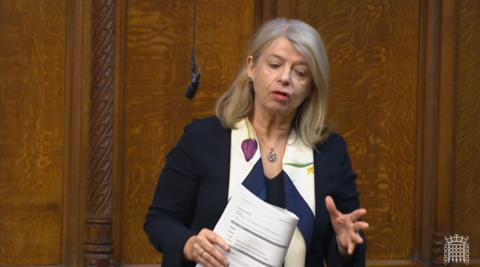

Harriett Baldwin welcomes HMRC’s backtrack on its plans to shut the self-assessment helpline every year between April and September, whilst she backs the long-term strategy to move people online, she says it cannot be done by randomly shutting down telephone helplines.

Harriett Baldwin highlights an article in which the independent director of the Institute for Fiscal Studies confirms the average UK earner now has the lowest effective personal tax rate since 1975—lower than in America, France, Germany or any G7 country.

Harriett Baldwin, Chair of the Treasury Select Committee, welcomes the Chancellor’s tax-cutting Budget and supports the Government’s plan to get inflation down; to increase the growth rate and the growth capacity of the UK economy, without sparking inflation again; and to get debt falling.

Harriett Baldwin welcomes the 110 pro-growth measures in the Bill and thanks the Treasury team for their hard work on this. She also calls on the Government to implement the promised proposal to allow people to put fractional shares into their individual savings accounts (ISAs).

Harriett Baldwin speaks in Parliament about her recent visit to Our Place—an independent provider—which provides specialist education, mainly for children with autism, and asks if this school would be impacted should a tax on independent schools be introduced.

Harriett Baldwin highlights the constitutional sexism in the House of Lords where an eighth of the seats are reserved for men as a result of the hereditary peerages passing down to the oldest son and calls on the Government to support her Hereditary Titles (Female Succession) Bill which would ensure that the succession of peerages moves in line with that of the Crown.